NEW PHONE NUMBER 517-258-0038 | God is still speaking

NEW PHONE NUMBER 517-258-0038 | God is still speaking

Michigan Conference of the United Church of Christ

No matter who you are, or where you are on life’s journey – you are welcome here.

Welcome to the wonderful world of the Michigan Conference, where, when you’ve seen one church, you’ve seen one church. We have churches by cherry orchards, rust belts, tourist towns of fudge shops and food deserts without grocery stores, vacation mansions alongside a serious shortage of affordable housing, and pure recreational lakes down the road from cities whose drinking water is dirty. From city apartments, farmhouses, lake cottages, vacation mansions and, we make our spiritual homes together in 135 churches that include all the rich contrasts of our beautiful state.

Since becoming Conference Minister in 2022, you can see from my speaking schedule that I have spent most weekends visiting them. I can testify that no matter the size or setting, you will find a fascinating and faithful spiritual home here, whether you are looking for a place to worship or a place to preach. We can have the oldest congregation in a small town and be the first in that same town to welcome the queer community. We have new church starts without the burden of a building, meeting online or in coffee shops. We have historic churches whose stained glass windows, woodwork and masonry are a blessing of art and transcendence to their communities. We have congregations that are unapologetically black and congregations that have Alpine festivals.

In large cities, rural villages, sprawling suburbs and fertile forests, our churches bear witness to the God who is still speaking, who desires justice and who welcomes all, no matter what, no matter who, no matter where you are on life’s journey. In the Michigan Conference, our Christian tradition may be two thousand years old but our thinking is not. If that sounds like you, come join us.

Peace and Blessings,

Groups meet on Wednesdays from 12:00noon – 1:00pm

Pastors and MIDs may join these Caring Clergy Communities on Zoom any time.

First Wednesday Leadership Lunch with Lillian Daniel

Second Wednesday Book of the Month with Jenn Ringgold

Third Wednesday Clergy Cafe with Cheryl Burke

Fourth Wednesday Spiritual Practices for Pastors with Lawrence Richardson

Member in Discernment (Second Thursday and Third Monday) and Retired Clergy Cafe (First Thursday starting May 2) are also available for drop in.

Inspired preaching, volunteer choir, blessed music, generous hospitality, business completed miraculously fast, a new Conference Resolution related to advocating as the church for Second-Look Legislation, nourishing food, fantastic fellowship, a revitalizing Keynote, and a sweet-sweet Spirit as we the people gathered to worship God and serve neighbor.

Recordings of the events of the day can be found in a playlist on the Michigan Conference UCC YouTube Channel.

PLAYLIST INCLUDES: Worship, Sermon, Business Meeting, Speak Outs, Keynote, and 2024 Annual Meeting Announcement

Please fill out this form to anonymously provide feedback regarding 2023 Annual Meeting (takes less than 3 minutes)

Resolution of Witness In Support of Second Look Sentencing Legislation

On October 28, 2023, the Michigan Conference Annual Gathering voted to approve a resolution in Support of Second Look Sentencing Legislation. The full resolution, a copy of this communication, and a sample advocacy letter can be found HERE

The action items from this resolution follow, with some ideas from the Prophetic Integrity Mission Area Team about how to participate.

Therefore, be it Resolved that the 2023 Annual Meeting of the Michigan Conference United

Church of Christ supports House Bills 4556 – 4560 and Senate Bills 0321-0325.

Be it further resolved, that the clergy and lay people of the Michigan Conference UCC engage

in education around Second Look Sentencing legislation.

Some Resources for study:

https://famm.org/wp-content/uploads/Second-Look-Infographic.pdf

https://www.mlive.com/public-interest/2023/04/giving-michigan-prisoners-a-second-

look-could-earn-them-another-chance-at-life.html

https://www.nacdl.org/Content/Second-Look

Be it further resolved, that the clergy and lay people of the Michigan Conference UCC contact

their legislators in support of Second Look Sentencing legislation.

House Bills 4556-4560 have been referred to the Committee on Criminal Justice.

Senate Bills 0321-0325 have been referred to the Committees on Civil Rights, Judiciary

and Public Safety.

Supporting these bills can be done by writing or calling your legislators to voice your

support of the bills. (see sample letter)

You may find your legislators at: https://www.house.mi.gov/#findarepresentative

and https://senate.michigan.gov/FindYourSenator/

Learn, decide, act.

09.28.2023 Per the Michigan Conference UCC Bylaws – the Draft Agenda, Financial Report and any Resolutions, must be emailed and accessible to delegates 30 days prior to Annual Meeting

10.28.2023 All Documents needed for Annual Meeting are accessible in the link below

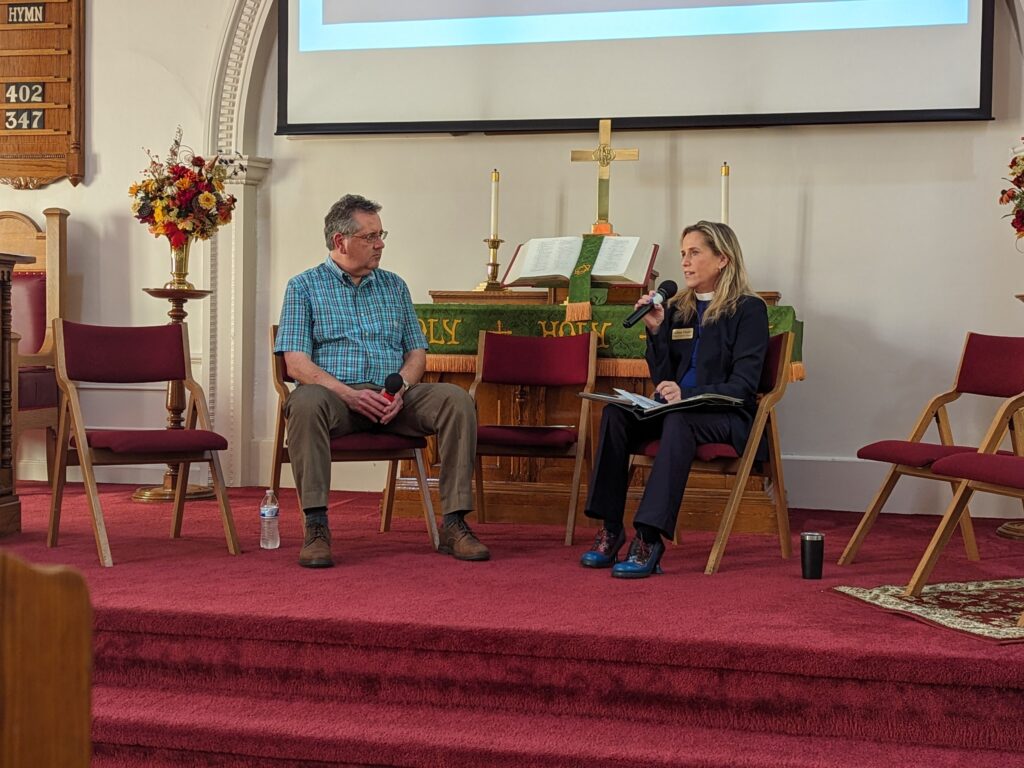

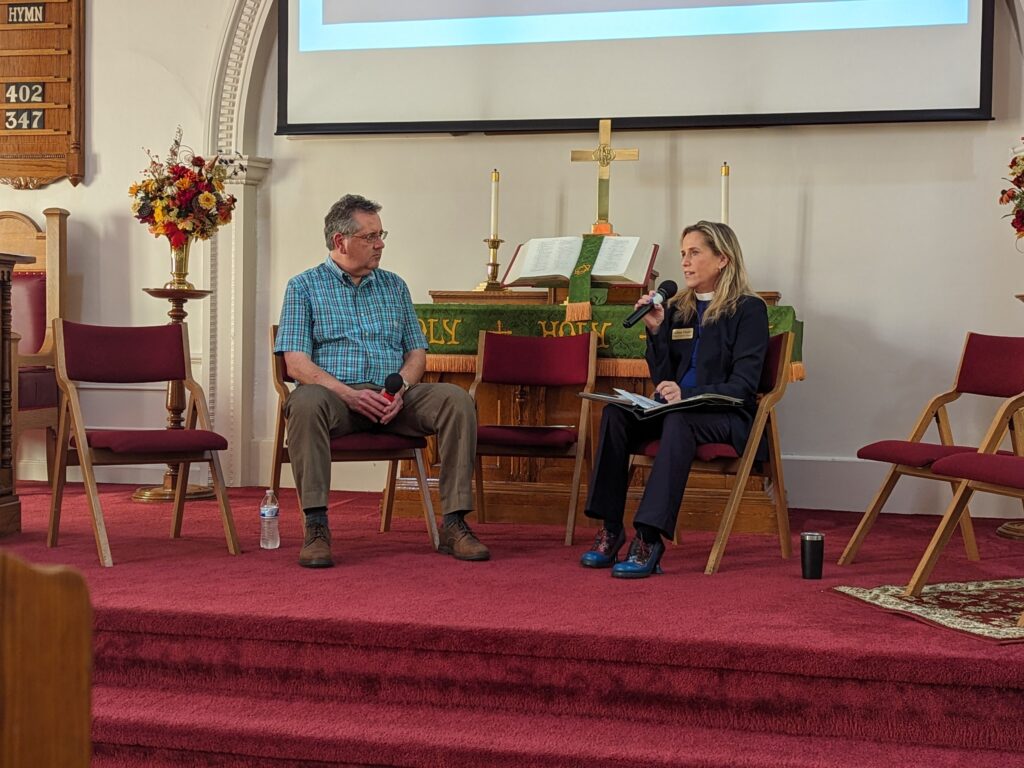

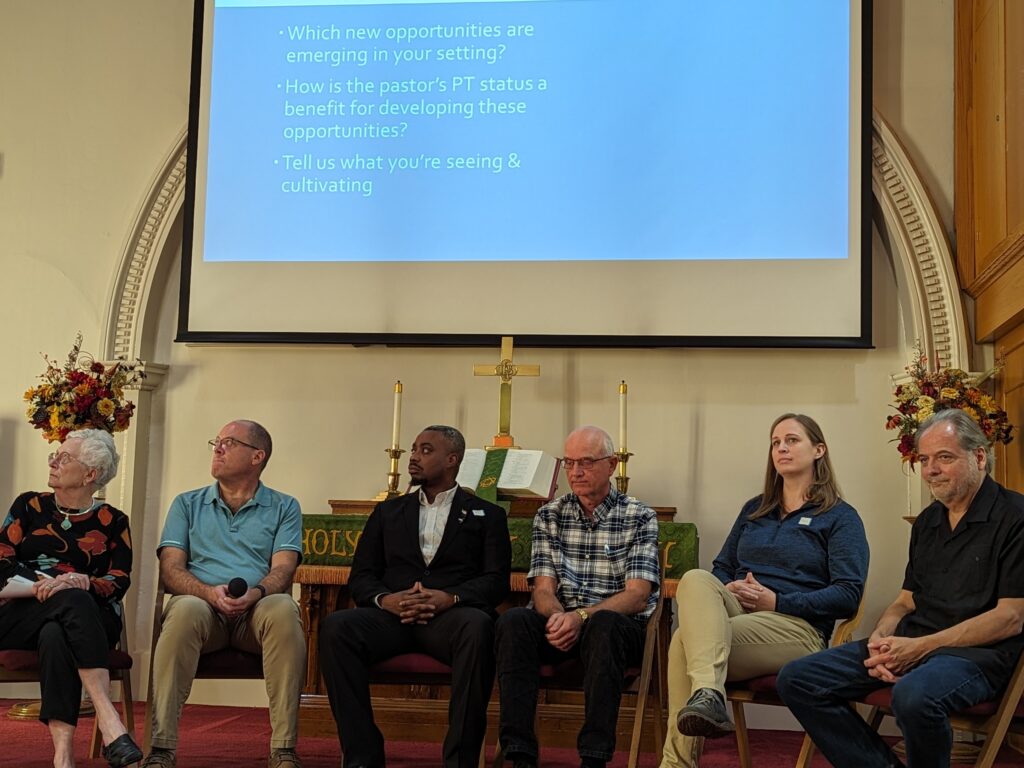

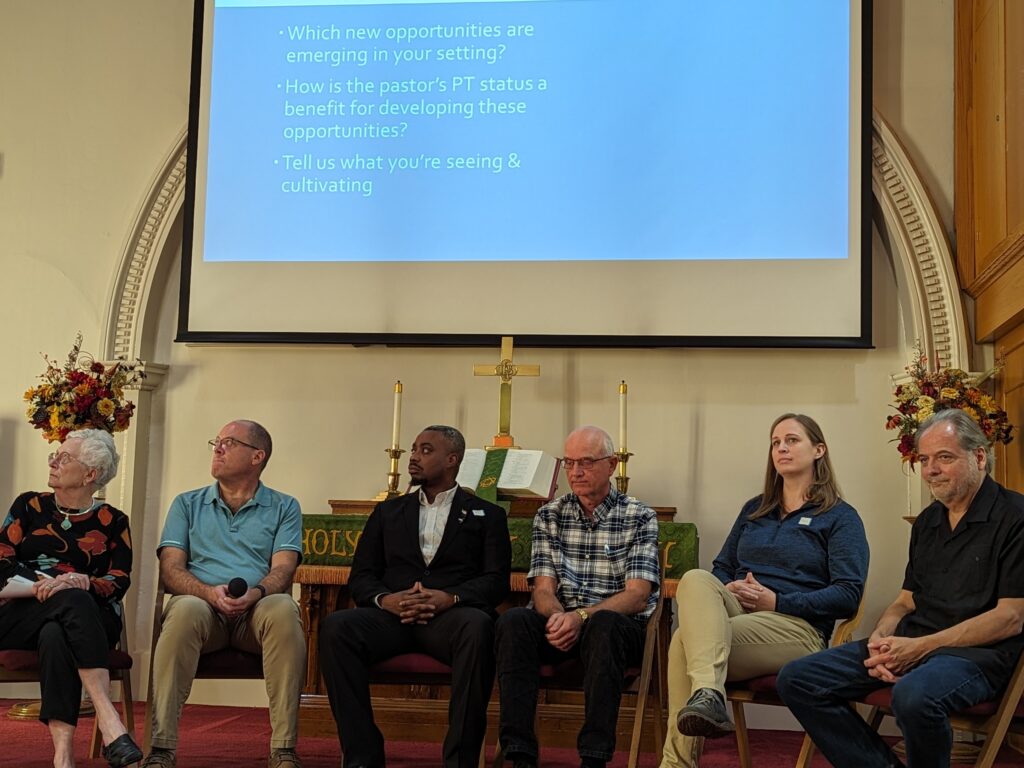

Over 60 clergy and lay leaders participated in our 2023 Vitality Day with author Rev. Jeff MacDonald. Hosted at St. John’s UCC in Owosso, the day was filled with innovative and detail-oriented discussions for how to adapt to the changing world of Part-Time ministry. With gratitude to our Vital Growth Mission Area Team and Associate Conference Minister Rev. Cheryl Burke for organizing and providing resources to supplement a thought-provoking event. With appreciation for panelists and participants for a day filled with great questions and conversation in-person and online!

Where do you see God is still speaking?

Sign up to receive our newsletter.